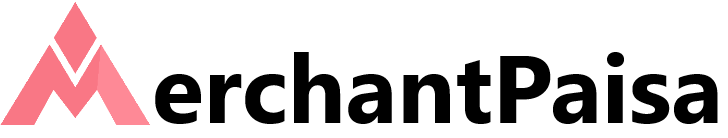

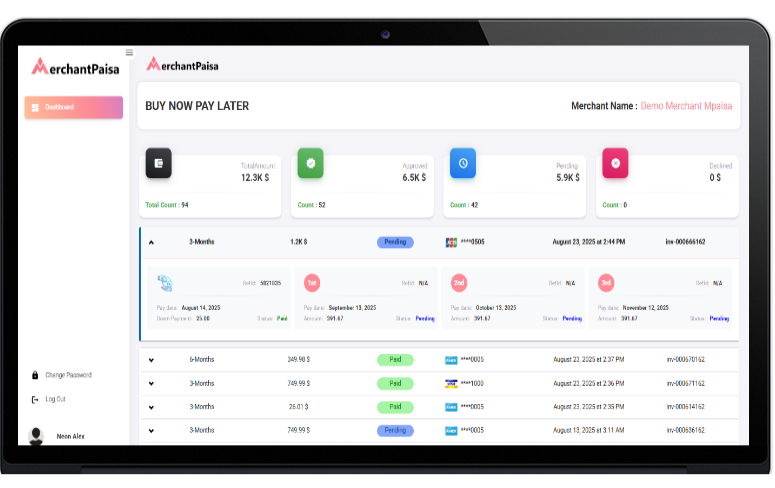

Product Features

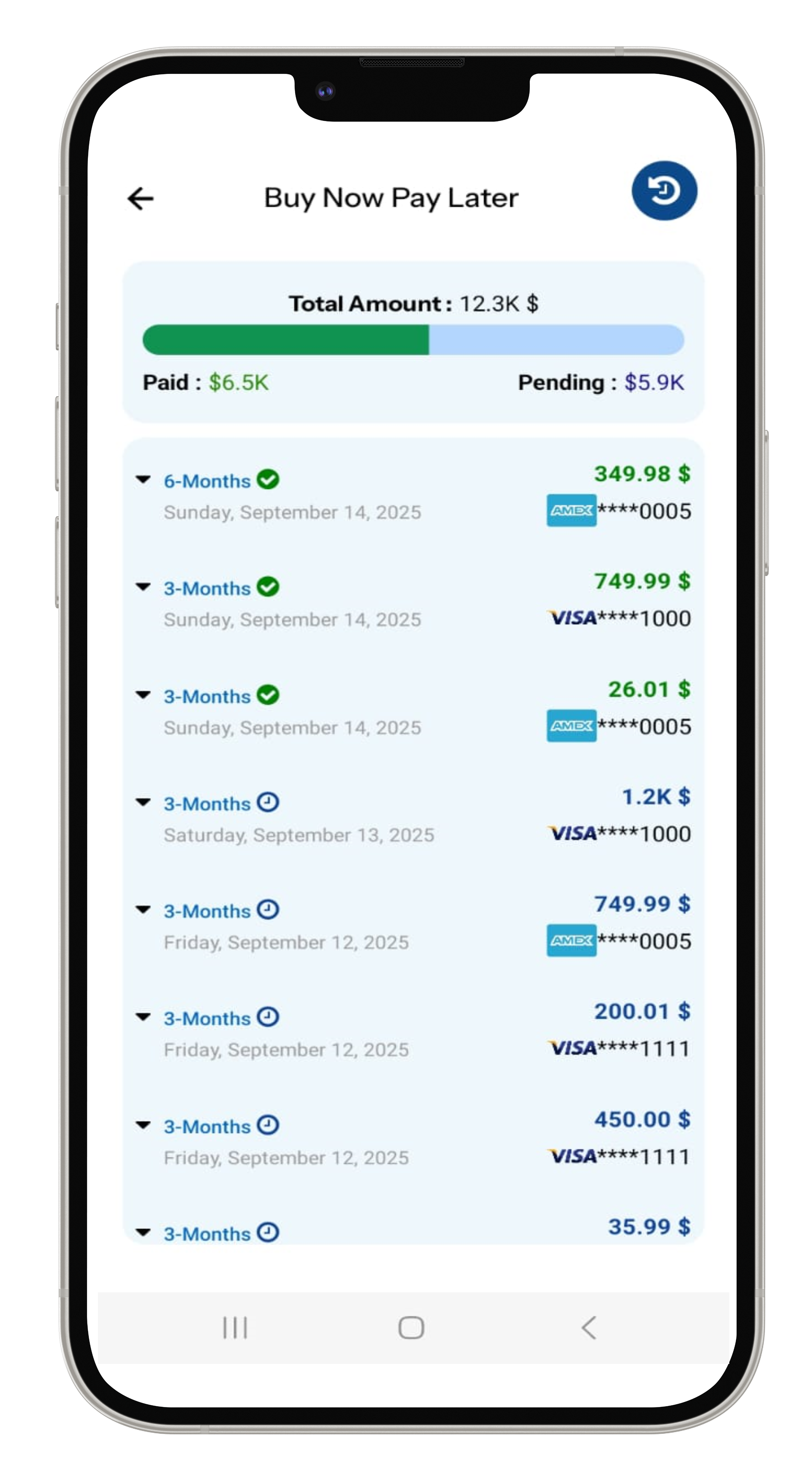

BNPL / Recurring PROCESS

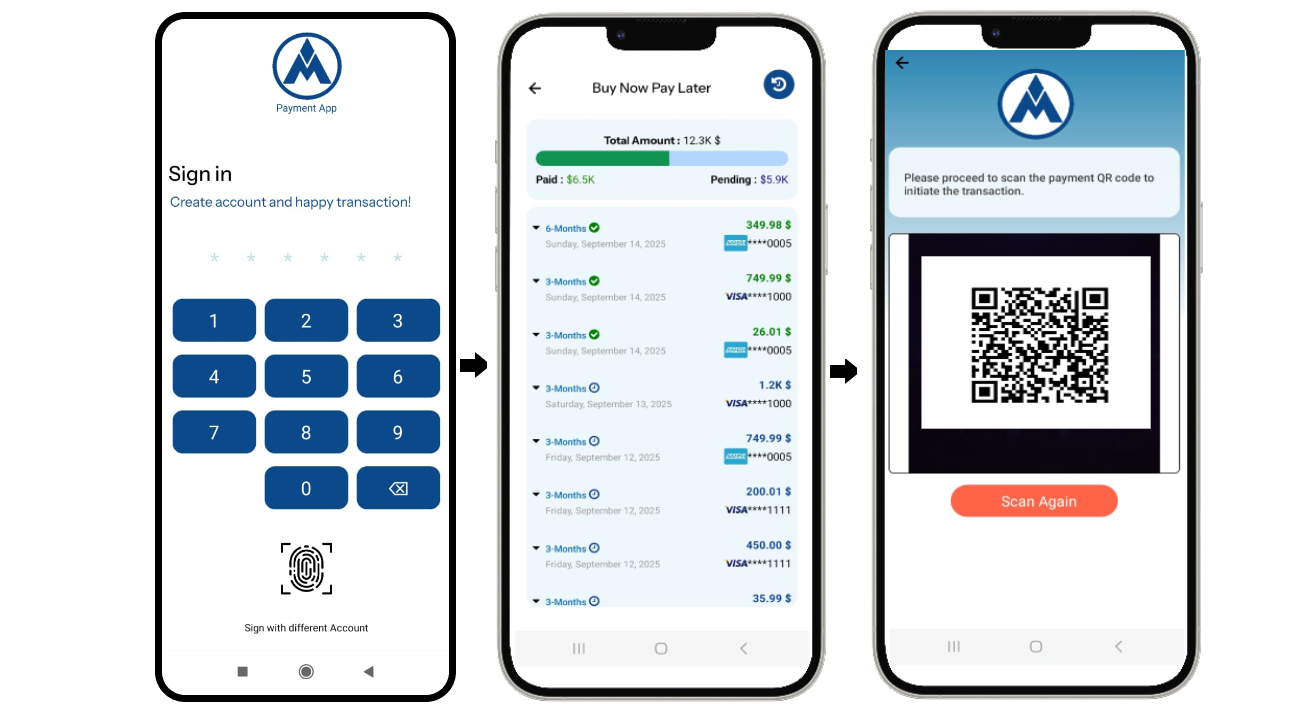

Step 1

The consumer selects their desired goods from the merchant's online store for BNPL process.

Step 2

They sign up for a BNPL / Recurring account by providing basic details.

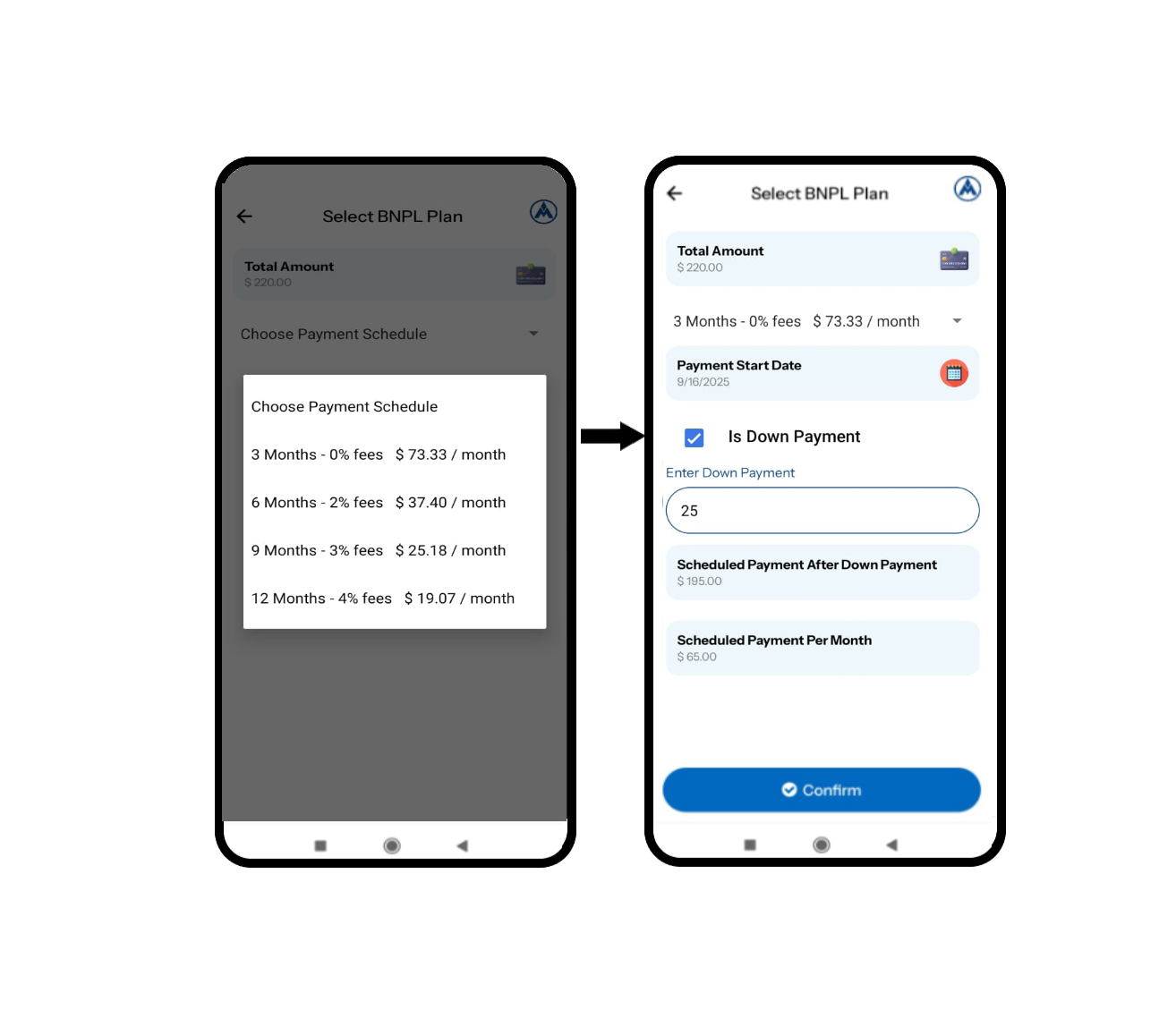

Step 3

Next, they choose a BNPL / Recurring installment plan (e.g., 3-month, 6-month, or 12-month options).

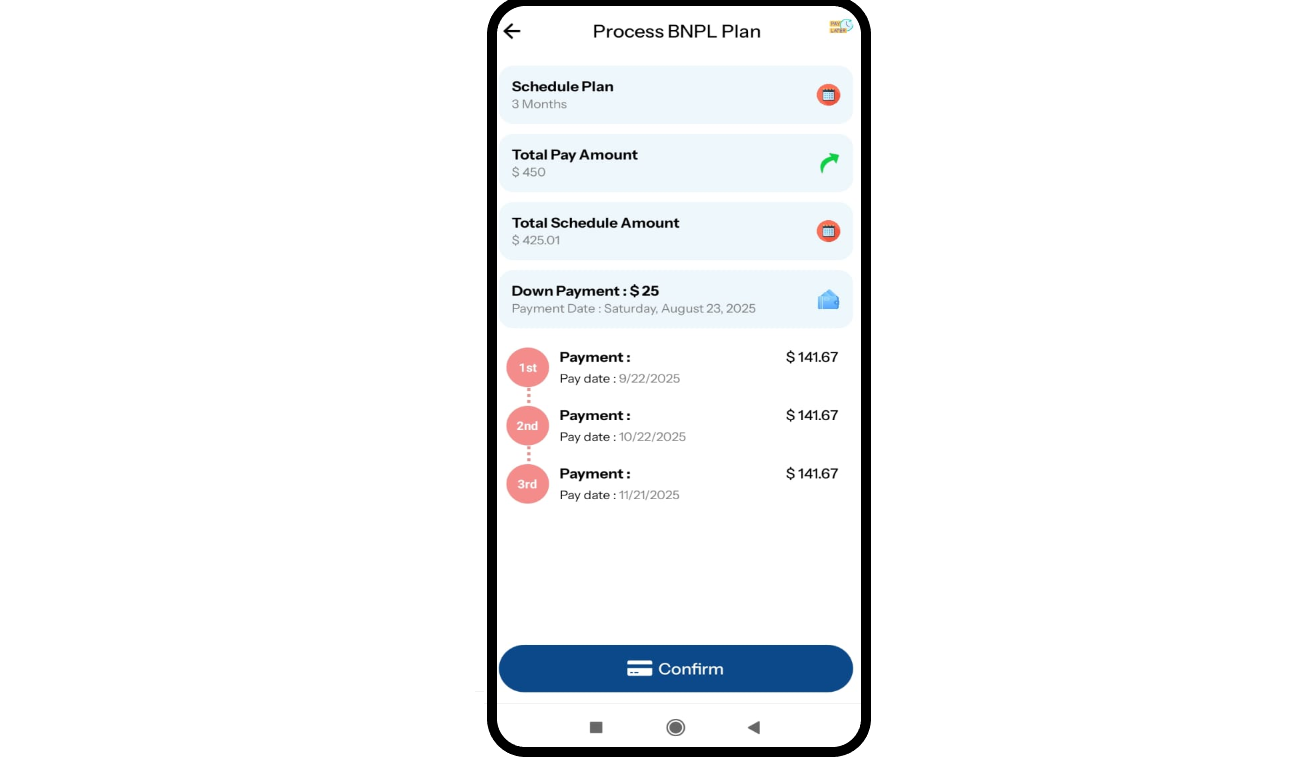

Step 4

If a down payment is required, they add it, then review the plan, including the payment start date and recurring installment amount.

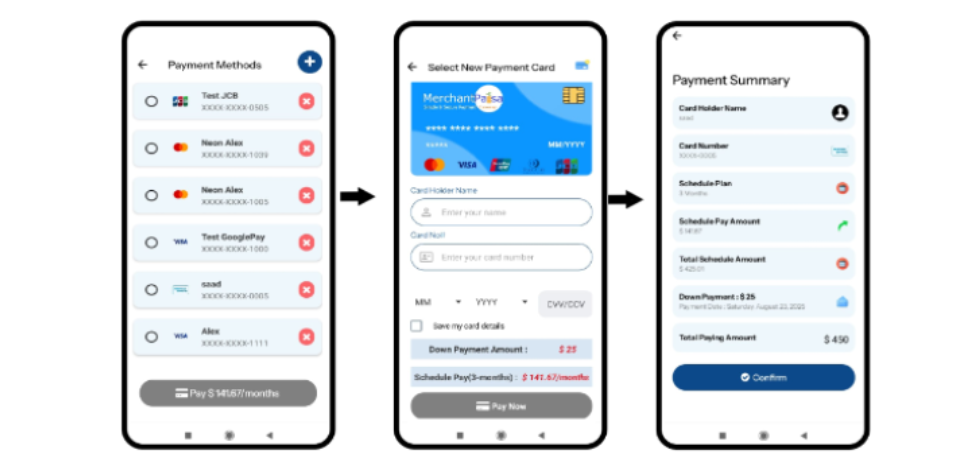

Step 5

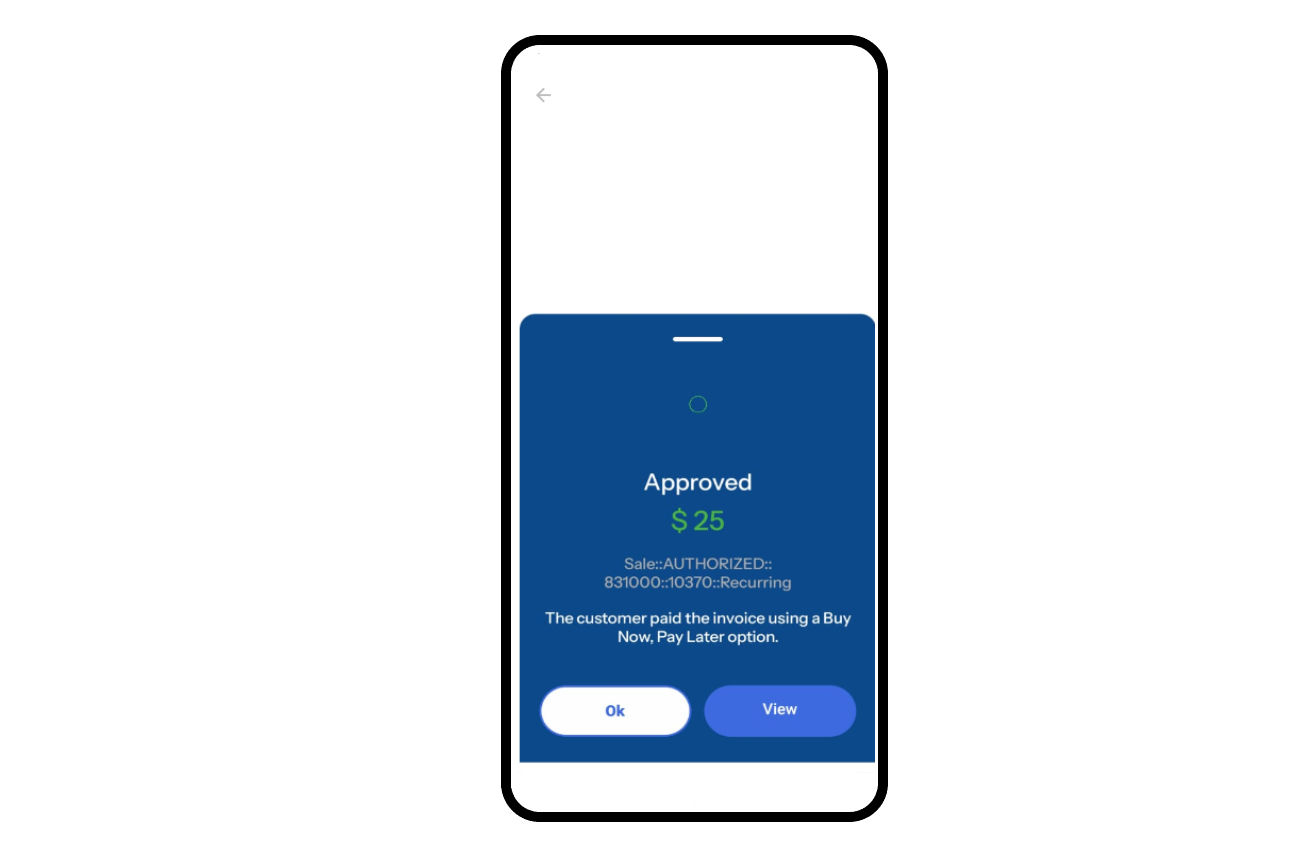

The consumer enters their card information and reviews the payment details.

Step 6

Once the payment is approved, the consumer receives the goods.

Third Party Integrations List

Lexis Nexis

WorldPay

UnionPay - China

MasterCard